About Us

Simple, affordable field service management software for teams in the field. Trusted by businesses worldwide.

Jump to

Summary

To pay field employees properly means paying through GPS-based tracking, geofencing, digital timesheets, and verified approvals before payroll runs.

Establish clear reporting policies for off-the-clock work, overtime approval, and travel time to prevent wage disputes early.

Follow FLSA rules, state overtime laws, travel compensation standards, and strict recordkeeping requirements to stay compliant.

Avoid common payroll mistakes like misclassification, unpaid compensable time, buddy punching, and incorrect mileage reimbursements.

Use payroll integration, automated alerts, and monthly audits to maintain accuracy, reduce errors, and protect against compliance risks.

How to make sure your field employees are paid properly starts with one simple principle: control the data before you process the paycheck. When you track time accurately, classify employees correctly, and verify hours before payroll runs, most wage errors disappear.

When I first handled field payroll, I was surprised. Because the faults came from messy time data, unclear overtime rules, and missed travel hours.

Field teams do not work in one place. They drive between job sites, take after-hours calls, log mileage, and sometimes finish paperwork from home. That movement creates blind spots. And blind spots create underpayments, overpayments, and compliance risks.

So instead of reacting to payroll complaints, you need a structured approach.

In this blog, we will break down the legal rules, common payroll mistakes, and best practices that protect field payroll. You will see how to build a system that prevents errors before payday.

When I started managing field payroll, I assumed payroll errors came from bad calculations. They didn’t.

They came from bad time data, unclear policies, and zero verification before payday. Field teams work on the road, between job sites, and sometimes outside normal hours. That complexity is exactly where payroll mistakes happen.

So I built a structured system. Here’s how to make sure your field employees are paid properly:

Accurate payroll starts with accurate time tracking. If field employees log time late, manually, or from memory, errors become unavoidable.

That is why mobile time clocks are non-negotiable in field operations. When technicians clock in through GPS-enabled apps, you capture both time and location. This reduces buddy punching and false entries.

This is important because 75% of employers experience losses from buddy punching, with average annual costs around $1,560 per employee. However, GPS alone does not solve everything.

Geofencing adds another control layer. When you set job site boundaries, employees can only clock in inside approved locations. This prevents early clock-ins from home and protects you from being required to pay non-compensable commute time.

Digital timesheets complete the foundation. Paper logs create disputes because someone always forgets details. Digital records store timestamps automatically and build a clean audit trail, which helps meet IRS payroll recordkeeping requirements.

This is where FieldServicely helped me. When job scheduling, route tracking, and time capture live in one place, payroll becomes more aligned with actual field activity. It cut my extra reconciliation work, too!

Turn field activity into accurate payroll automatically

Use GPS tracking, job-linked clock-ins, and instant timesheets

Clear payroll rules prevent most wage disputes before they start. Many field payroll problems happen because employees do not fully understand what counts as paid time.

So define it clearly.

Off-the-clock work must not happen. If a technician answers a client call after hours or prepares tools before a shift, that time must be logged. The U.S. Department of Labor recovered over $274 million in back wages.

Did you know this was largely from wage and hour violations, many tied to unpaid work time?

Overtime approval workflows also matter. Non-exempt employees must receive at least 1.5 times their regular rate for hours over 40 in a workweek under federal law. A structured approval process ensures managers review overtime before payroll processes it.

Travel reporting guidelines remove confusion. The Department of Labor states that travel between job sites during the workday counts as paid time, but a normal commute does not.

Writing this into policy prevents both underpayments and inflated travel claims. When policies stay simple and documented, employees report time more consistently.

Timesheets should never move straight to payroll. A verification layer prevents small errors from becoming major liabilities.

Supervisor review comes first. Managers should compare reported hours against job assignments and schedules. If someone logs 10 hours but the service ticket reflects 8, that discrepancy needs correction before payday.

GPS cross-checking strengthens that review. If timesheets show a full day onsite but GPS logs reveal gaps, those inconsistencies must be resolved. This protects compliance during audits and wage investigations.

Exception reporting adds automation to oversight. Payroll systems can flag excessive overtime, missed punches, or duplicate entries. Instead of manually searching for errors, the system highlights them.

Manual data entry introduces avoidable mistakes. Every retype increases the chance of error.

So sync approved time data directly with payroll software. When hours flow automatically from time tracking systems into payroll platforms, you eliminate duplication and reduce calculation errors.

This also protects tax compliance. The IRS requires accurate payroll tax withholding and reporting. Automated syncing ensures gross pay, deductions, and overtime multipliers align with actual tracked hours. [Source: IRS]

Overtime alerts provide another safeguard. When employees approach 40 hours a week, managers receive a notification. In states with stricter overtime rules, such as California’s daily overtime requirements, these alerts prevent accidental violations.

Field service automation does not remove accountability. It removes preventable human error.

Even strong payroll systems drift over time. That is why monthly audits are critical.

Random employee audits keep reporting honesty. Comparing timesheets against GPS logs and job records each month creates documented proof of internal payroll controls.

Overtime trend reviews reveal operational issues. If one team consistently exceeds overtime limits, that may signal staffing gaps or scheduling inefficiencies. Reviewing patterns helps manage labor costs and reduce burnout.

Mileage verification protects reimbursements. The IRS standard mileage rate for 2025 is 70 cents per mile. Cross-checking logged mileage against route data ensures employees receive fair reimbursement while preventing inflated claims.

Monthly reviews close the loop. They confirm that time capture, policies, verification, and automation work together as intended.

Take control of field payroll before compliance becomes a problem

When I started digging into field payroll compliance, I realized payroll errors are usually about ignoring labor law details.

So before you optimize anything, you must understand the legal ground rules.

The Fair Labor Standards Act is the starting point. If you have non-exempt field employees, you must follow their overtime, minimum wage, and recordkeeping rules. There is no shortcut around it.

First, let’s talk overtime.

Overtime under federal law kicks in after 40 hours in a fixed 168-hour workweek. You must pay at least 1.5 times the employee’s regular rate for those extra hours. And here’s what many employers miss: bonuses and commissions must be included in the regular rate calculation, according to the U.S. Department of Labor. [Source: Fair Labor Standards Act]

Next comes minimum wage.

Federal minimum wage still stands at $7.25 per hour, but many states set higher rates. If you operate in places like California or New York, you must follow the higher local rate, not the federal one.

The Department of Labor continues to enforce minimum wage violations aggressively. Even they recovered $274 million for workers who weren’t paid properly.

Then comes recordkeeping.

The FLSA requires you to maintain accurate records of hours worked, pay rates, overtime earnings, and total wages paid. During audits, investigators focus first on documentation. If you cannot show clean records, your defense weakens immediately.

Now let’s address travel time, because this is where most field payroll mistakes happen.

Home-to-work travel is usually not paid. Driving from home to the first job site counts as normal commuting under the Portal-to-Portal Act. That rule surprises many employers and employees alike.

However, travel during the workday is different.

If a technician drives from Job Site A to Job Site B, that time counts as paid work time. The U.S. Department of Labor clearly states that travel between job sites during the workday is compensable. [Source: DOL]

Overnight travel adds another layer.

If an employee travels during their normal working hours, even on a weekend, you must pay for those hours. For example, if a field engineer normally works 8 a.m. to 5 p.m., travel during that window counts as paid time.

Same-day special assignments follow similar logic.

If you send an employee to another city for a one-day job, you must pay travel time minus the employee’s normal commute. This rule often gets overlooked, and that oversight can trigger wage claims.

Federal law sets the floor. States often raise it. California is a perfect example.

In California, daily overtime applies after 8 hours in a single day, not just after 40 hours in a week. That means a 10-hour shift triggers two hours of overtime even if the employee works only 38 hours that week.

Prevailing wage laws also change the equation.

Under the Davis-Bacon Act, contractors on federally funded public works projects must pay local prevailing wages. These wages often exceed standard market rates and include required fringe benefits.

Union wage agreements add another layer.

Collective bargaining agreements may define different overtime rules, shift premiums, and travel pay conditions. If your field team operates under a union contract, that agreement overrides standard company policy.

So when you operate across multiple states or projects, you cannot rely on one uniform payroll rule. You must review each jurisdiction carefully.

Even if you pay correctly, you still need proof.

The FLSA requires employers to keep payroll records for at least three years. Basic time cards, work schedules, and wage computation data must remain accessible for at least two years, according to the U.S. Department of Labor.

Required documentation includes employee name, occupation, workweek start time, daily hours worked, total weekly hours, pay rate, and overtime earnings. Missing even one of these details can create compliance gaps.

Digital storage helps here.

When you store timesheets digitally, timestamps remain intact, and audit trails stay clear. Paper records, on the other hand, are easier to alter and harder to defend.

Audit preparation should not start when an investigation notice arrives.

It should be ongoing. When your payroll data stays organized and retrievable, audits become manageable instead of stressful.

Make FLSA compliance easier for your field teams

Misclassification creates one of the most expensive payroll mistakes. When you label someone incorrectly, every paycheck that follows may be wrong.

Exempt vs non-exempt confusion happens the most. Just because a field supervisor earns a salary does not mean they qualify as exempt under FLSA rules. The Department of Labor requires both a salary threshold and specific job duties, and failing either test means overtime applies. [Source: DOL]

Independent contractor misclassification creates even bigger exposure. When you treat a worker like a contractor but control their schedule, tools, and assignments, you likely misclassify them under IRS guidelines.

Once misclassification happens, corrections require retroactive overtime, tax adjustments, and often penalties. And that damage adds up quickly.

Underpaying field workers often starts with small, overlooked minutes. But small minutes repeated daily become serious wage violations.

Equipment prep time must be paid when it is required for the job. If a technician must load tools, test equipment, or review safety checklists before clocking in, that time qualifies as compensable work under FLSA standards.

Post-shift administrative tasks also count. If employees complete reports, update service logs, or respond to client emails after leaving the job site, those tasks fall under “hours worked”.

On-call time becomes tricky but important. If employees must stay near their vehicle, respond immediately, or limit personal activity, courts often consider that time compensable. Failing to evaluate on-call policies properly creates recurring underpayment risks.

So paying for all compensable time is the legal baseline.

Time tracking errors multiply quickly in field environments. And most of them begin with outdated systems.

Manual logs create time-punch errors at scale. Average employer loss $1560 per employee per year due to buddy punching. Each correction consumes payroll staff time and increases frustration.

Proxy clock-ins, often called buddy punching, also distort payroll. When one employee clocks in for another, hours inflate without actual work being performed.

GPS discrepancies create another blind spot. If a timesheet shows eight hours onsite but route tracking shows only five, you face either overpayment or a dispute. Without accurate digital tracking, you rely on memory instead of data.

And in payroll, memory is unreliable.

Expense reimbursement mistakes create both compliance and morale problems. Field workers often pay upfront for fuel, tolls, meals, and tools.

IRS mileage rates must guide reimbursements. And using outdated rates creates underpayment or overpayment issues. If expenses push effective pay below minimum wage, that becomes a compliance problem.

Per diem confusion causes additional errors. When employers mix flat daily allowances with actual expense reimbursements without clear rules, overpayments or missing reimbursements occur.

Missing documentation makes it worse. Without receipts, mileage logs, or approval records, employers struggle to defend reimbursements during audits. And once documentation fails, trust erodes quickly.

Don’t let small payroll gaps become expensive penalties

Track field hours, mileage, and overtime accurately

Field workers move between job sites, clock in from phones, and often submit hours late, which creates room for mistakes.

So instead of correcting payroll after complaints, smart technology prevents the mistake before it happens.

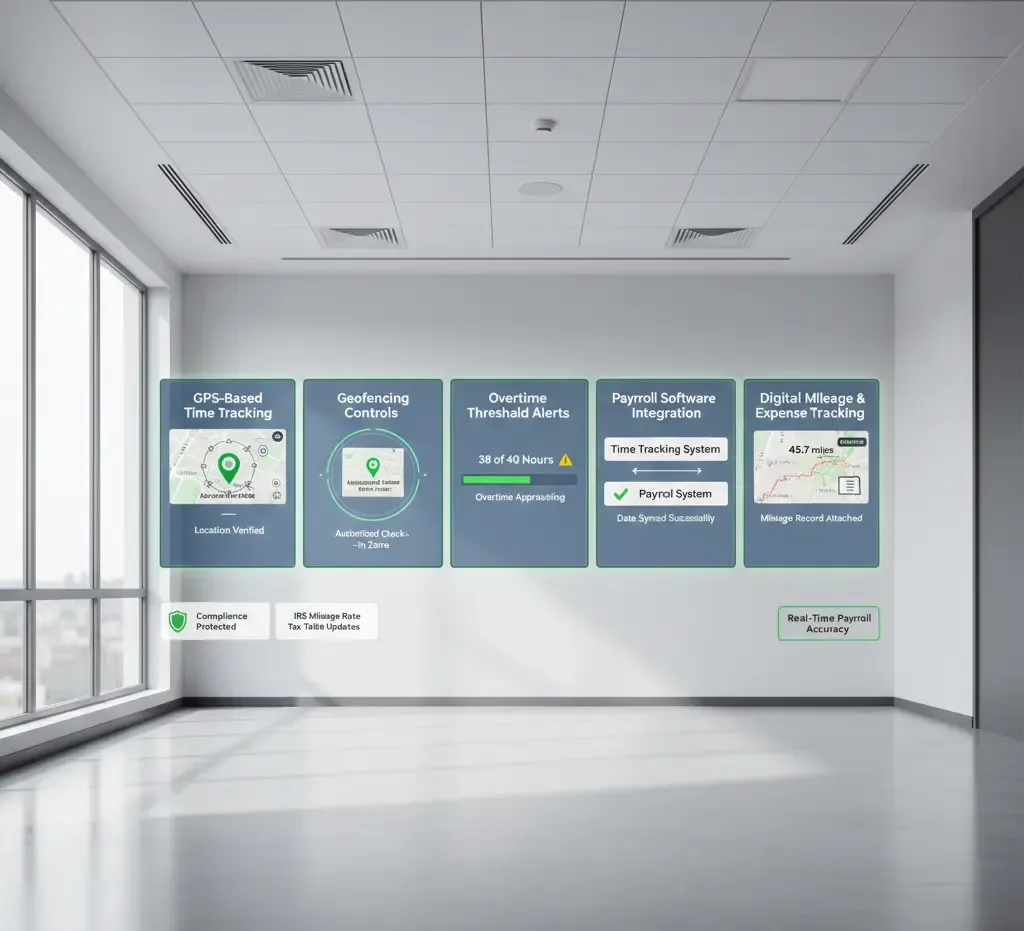

GPS-based time tracking answers one simple question: where did the work happen?

When a field technician clocks in, the system records the exact location and time automatically. This removes arguments about late arrivals or early clock-ins.

Time theft costs real money. GPS tracking policy reduces inflated hours because every entry ties to a verified job site.

More importantly, GPS logs protect you during disputes. If someone claims unpaid overtime, you can match time records with service calls and dispatch data. It strengthens compliance immediately.

Tools like FieldServicely use real-time location tracking and automated timesheets to simplify this process without adding manual oversight. That keeps payroll accurate while maintaining accountability for field teams.

Control payroll accuracy with real-time GPS tracking

Track every clock-in by location and generate instant timesheets

Geofencing controls where employees can clock in. When you create a digital boundary around a project site, workers must be inside that area to start their shift. This ensures you only pay for authorized, on-site labor.

Wage disputes often start with small time gaps. Geofencing prevents that issue by enforcing attendance rules in real time.

At the same time, it builds fairness. Employees know the system applies equally to everyone, which reduces conflict over time entries.

Automated overtime alerts prevent payroll surprises. When a worker approaches 40 hours in a week, the system notifies the supervisor instantly. This allows schedule adjustments before overtime triggers.

Overtime violations remain one of the top wage claims under the Fair Labor Standards Act. Even small miscalculations can lead to penalties and back pay. Automation removes manual math errors completely.

It also creates predictability. Managers can control labor costs while still paying employees correctly and on time.

Payroll integration answers another critical question: Did the hours transfer correctly? When your time tracking system syncs directly with payroll software, it moves approved hours automatically. This removes double data entry and typing mistakes.

Each payroll error costs hundreds of dollars to fix once you factor in voided checks and HR time. Integration reduces those correction cycles dramatically.

It also keeps tax calculations accurate. Modern payroll platforms update tax tables and wage rules automatically, which reduces compliance risk across multiple states.

Digital mileage tracking solves reimbursement disputes quickly. When a field employee drives between sites, the system records actual miles instead of relying on handwritten logs. Thus, it ensures fair and accurate reimbursement.

The IRS sets a standard mileage rate each year, and employers must calculate it correctly. Manual logs often lead to rounding errors or missing trips. GPS-based mileage tools prevent that entirely.

Digital expense tracking also creates clean documentation. Employees upload receipts directly, and the system attaches them to the trip record. It speeds up approval and prepares you for audits without extra paperwork.

By this point, you already know how to track time, calculate overtime, and stay compliant. But even with strong systems in place, payroll can still break down.

Why?

Because payroll accuracy is not only about tools. It is about governance, accountability, and consistency across the organization.

So this section focuses on leadership-level best practices that prevent payroll breakdown at scale:

Correct classification protects your payroll foundation. If you misclassify even one field employee, every paycheck after that becomes legally risky.

The Department of Labor continues to prioritize misclassification enforcement in construction and field service industries. When classification is wrong, retroactive overtime and penalties follow quickly.

So review job duties annually, not just at hiring. Roles evolve in the field, and payroll status must evolve with them.

Overtime accuracy depends on how you define the “regular rate.” Many employers calculate overtime on base pay only, but federal guidance requires the inclusion of certain bonuses and incentive pay.

This detail often gets ignored.

If field teams earn productivity bonuses, those payments may impact overtime rate calculations. Failing to include them creates underpayment risk even when total hours are correct.

Review compensation structures whenever incentive programs change.

Field operations expand. New service territories mean new travel patterns.

When teams begin operating in new regions, you must reassess whether compensation policies still align with legal guidance. What worked last year may not match expanded routing today.

Operational growth requires a compliance review. Expansion without review creates payroll exposure.

Mileage programs drift over time. Drivers change vehicles, routes expand, and reimbursement policies get outdated.

Best practice means auditing reimbursement formulas whenever business operations shift. If your team adds longer service routes, you must validate that reimbursement still reflects actual cost structures.

Reimbursement is not just about fairness. It protects minimum wage compliance indirectly.

Multi-state operations increase payroll tax complexity. If your field teams cross state lines, withholding obligations may change.

Recent workforce mobility trends show more employees working across jurisdictions. When tax registration does not match work location, compliance gaps appear.

So review payroll tax setup whenever you add new service areas.

Documentation is not just about storage. It is about defensibility.

If a wage dispute arises, your documentation must show approval, review, and validation steps clearly. Clean documentation demonstrates internal controls, not just recordkeeping.

That difference is important during investigations.

Audit trails prove governance. If your system tracks edits, approvals, and adjustments transparently, you reduce internal fraud risk and external compliance exposure.

Strong audit trails show intent to comply. Weak trails suggest disorder.

Payroll governance is about visibility, not just numbers.

State labor laws change frequently. Minimum wage adjustments, overtime thresholds, and pay transparency laws continue evolving across jurisdictions.

Best practice means reviewing state requirements annually, not reacting after enforcement actions. Proactive review prevents reactive correction.

Compliance is not a one-time checklist. It is an ongoing discipline.

If you truly want to answer how to make sure your field employees are paid properly, focus on prevention, not correction. Build clear policies, enforce verification, and review regularly. When the process stays tight, pay stays accurate.

Field payroll fails when systems lack structure. When you control classification, verify compensable time, document mileage, review overtime, and maintain clean records, payroll becomes predictable. And predictable payroll builds trust.

Turn payroll oversight into a controlled system

Monitor hours, reimbursements, and audit trails with full visibility

You should follow state wage payment laws when setting payroll frequency. Some states require biweekly or semimonthly payroll, and late payments can trigger penalties under state labor codes. Regular payroll cycles reduce disputes and help employees plan their finances.

Yes, mandatory training time counts as compensable work under the Fair Labor Standards Act. If the training is required by the employer and relates to the job, you must pay for it. Failing to do so can create back wage liability.

Late wage payments can trigger state penalties and liquidated damages. Many states impose waiting time penalties for delayed final paychecks. Repeated late payments also increase audit risk and employee complaints.

Yes, clear pay stubs improve transparency and reduce disputes. Several states require employers to list hours worked, pay rate, overtime, and deductions. Detailed pay statements also protect employers during wage claims.

You must follow the labor laws of the state where the work is performed. This includes minimum wage rates, overtime rules, and tax withholding requirements. Multi-state payroll requires careful review to avoid compliance violations.

You should maintain time records, pay rates, overtime calculations, reimbursement logs, and tax withholding documentation. Federal law generally requires payroll records to be kept for at least three years. Organized digital storage strengthens your defense during investigations.

Simple, affordable field service management software for teams in the field. Trusted by businesses worldwide.

Discover how much do electricians make yearly and hourly. Learn about the average electrician salary, factors that influence earnings, jobs and more.

Learn about the top field service management best practices. Use them to optimize your field operations and provide more effective service.